Determination of remuneration for service invention in Turkey

The law stipulates the main regulations on the determination and payment of remuneration for service invention in Turkey, and the regulation regulates the subject in detail.

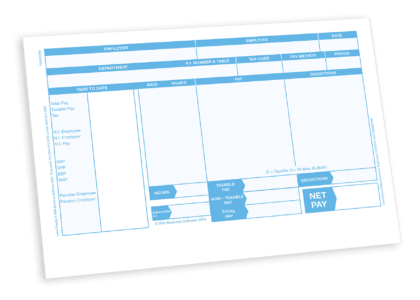

According to Article 10 of the Regulation on the determination of the remuneration in Turkey, the economic value of the service invention, the employee’s duty in the enterprise and the contribution of the enterprise to the realization of the service invention shall be taken into consideration. Afterwards, the amount of the remuneration in Turkey shall be found by multiplying the earnings obtained from the invention by the coefficients given in the table below based on the group to which the invention belongs.

The profit obtained from the invention is accepted as the profit equal to the sum of the profit obtained in case the invention is used by the enterprise and the profit obtained through licence, transfer or exchange by not using the invention by the enterprise. Accordingly, and in accordance with the following regulations, it is seen that the Regulation divides the profit obtained from the invention into two as the profit obtained from the invention used by the enterprise and the profit obtained from the invention not used by the enterprise.

Article 12 of the Regulation stipulates the methods of determining the profit from the invention used by the enterprise. Within the scope of the Regulation, the criterion taken as a basis for the profit from the invention is the profit determined to be used in the application of the Corporate Tax General Communiqué (Serial No. 1) published in the Official Gazette dated 03.04.2007 and numbered 26482.

In the event that the profit from the invention is not determined within the scope stated above for the inventions used by the enterprise, the profit from the invention shall be calculated by one of the methods of comparison, determinable benefit derived by the enterprise from the invention and estimation.

Article 13 of the Regulation regulates the syllogism, Article 14 regulates the determined benefit derived by the company from the invention and Article 15 regulates the estimation methods.

According to the aforementioned Article 13, in terms of determining the profit from the invention by using the comparative method, the profits obtained from service inventions made in the industry branches where licence and sales agreement practices regarding similar products and procedures are common can be used. In this method, for comparable inventions, the profit obtained from the invention shall be calculated by multiplying the unit value of the invention determined by taking into account the licence or sales price in the comparative contract by the number of products, product weight or number of parts, and in the absence of a comparable free invention, the profit obtained from the invention shall be calculated by taking into account the contribution of the invention to the sales price of the product.

Article 14 of the regulation shall be taken into consideration in determining the profit obtained from the invention according to the benefit provided by the enterprise from the invention. This method will be applied primarily in determining the income from service inventions that provide savings to the enterprise. This method will also be used in determining the profit obtained from the invention related to the products, machinery and devices used in the enterprise or the production methods applied in the enterprise, where the profit obtained from the sale of the inventive product cannot be taken as a basis. Accordingly, the positive difference arising between the costs and revenues of the enterprise as a result of the use of the invention is accepted as the determinable benefit provided by the enterprise from the invention. Additionally, the expenses incurred for the invention before the realisation of the invention shall not be deducted from the income derived from the invention.

Article 15 deals with the estimation method. Accordingly, in order to apply the estimation method, there must be a situation in which the profit from the invention cannot be calculated by comparison method and according to the determinable benefit provided by the enterprise from the invention. In determining the profit from the invention by this method, the reasonable price that the employer would have to pay if it wanted to purchase the invention from a similar free inventor will be taken as basis.

Article 11 of the Regulation is based on the determination of the price by the parties. According to the regulation, the price and the method of payment shall be determined by the provisions of the contract or a similar legal relationship signed between the employer and the employee after the employer makes a full or partial claim for the service invention. If the parties do not understand, the dispute will be resolved through arbitration.

The amount of the remuneration in Turkey to employees of public institutions and organisations for their inventions shall not be less than one third of the net income obtained from the invention. However, if the subject matter of the invention is used by the public institution and organisation itself, the consideration to be paid shall not be more than ten times the net wage paid to the employee for the month in which the consideration is paid, for one time only. In determining the remuneration in Turkey, the provision of the first paragraph of Article 10, especially the economic value of the service invention, the employee’s duty in the enterprise and the contribution of the enterprise to the realization of the service invention shall be taken into consideration. The net income obtained from the invention shall be calculated by deducting all kinds of expenses incurred for the work in which the invention is realized from the income obtained from the invention.

The regulations regarding the income obtained from the invention not used by the enterprise are included in Articles 16, 17 and 18 of the regulation.

The profit obtained from the invention not used by the enterprise is evaluated in the context of licence agreements, sales agreements and barter agreements.

The first situation is the situation where the service invention is not used by the enterprise and is exploited by granting a licence. According to Article 16 of the Regulation, in such a case, the profit derived from the invention shall be equal to the net income from the grant of the licence. Net income shall be found by deducting the expenses incurred for the development of the invention after the realisation of the invention, the expenses incurred to make the invention usable and the expenses incurred in relation to the granting of the licence from the gross income obtained from the granting of the licence. Additionally, in the determination of the net licence income, all kinds of expenses undertaken by the employer as a licensor for the protection of the patent right and the expenses related to the prevention of infringement of patent rights and granting guarantees should also be deducted from the gross income.

In Article 17 of the Regulation, sales contracts are discussed among the methods of earning from inventions that are not used by the enterprise. Accordingly, in the event that the service invention is not used by the enterprise and is utilised by sale, the gain from the invention is the net income obtained from the sale of the invention.

The last method in this regard is the exchange agreements and is discussed in Article 18 of the regulation. Accordingly, in the event that the service invention is not used by the enterprise and is utilised by being exchanged, in order to determine the share of the invention in the total profit provided by the employer from the exchange agreement, firstly, the amount of this profit will be determined. If this is not possible, the value of the invention shall be determined by the estimation method mentioned above.

Article 19 of the Regulation clarifies the use of more than one invention in a product or method. Accordingly, firstly, in a method applied or a product produced by using more than one service invention together, if this method or product constitutes an integrity that should be evaluated together, the total profit obtained by using these inventions will be determined in order to determine the profit obtained from each invention. Subsequently, this profit shall be allocated to the inventions used, taking into account the contribution of each invention to a method applied or a product produced by using more than one service invention together.