What is the wage according to the percentage method in Turkey ? 51. and 52. articles of the labour law numbered 4857 and the “Regulation on the Distribution of Money Collected from Percentages to Workers” published in the Official Gazette dated 28.02. 2004 dated 28.02.2004 and numbered 25387 published in the Official Gazette and entered into force in accordance with the provisions of the “Regulation on the Distribution of Money Collected from Percentages to Workers”, hotels, restaurants, entertainment places and similar places and places where the “percentage” method is applied in establishments where workers are given and where they sell various foods to be eaten and drunk immediately there, The employer is obliged to pay in full to all employees working in the workplace and to document this situation, the money received by the employer in return for service or under other names by adding a “percentage” to the customer’s account receipts or separately, and the money left to the employer by the customer at his own request or collected together under the control of the employer.

A number of issues need to be taken into account when making such a fee payment. The first of these is related to the distribution of percentages;

- The distribution of the percentages shall be based on the sum of the percentages obtained from all services in the workplace and the work actually performed by the workers.

- Each worker working in the workplace will benefit from the percentages collected in the score sheet according to the number of days he/she actually works and the score he/she obtains.

- The points belonging to the Overtime and Working for Excessive Periodshours of the workers who work Overtime and Working for Excessive Periodshours will be added to their normal points. The difference between the unincreased wage of the overtime and overtime workers paid from the percentages and the wage in Turkey that should be paid with an increase shall be paid by the employer.

- In the event that a percentage is collected for additional works such as weddings, teas, balls and meetings, the wages of the workers temporarily hired for these works will be calculated by taking into account the work and job titles in the point table, this amount will not be below the wage in Turkey corresponding to the time worked and the workers hired for additional works cannot be employed in other jobs.

- Employers are obliged to announce the schedule showing the jobs, titles, points and rates of the money collected from the percentages to be distributed in a place where the workers can easily see it.

Again, according to the relevant provisions of the regulation, the following criteria should be considered in awarding points and paying wages:

- According to the nature of the work performed in the workplace, points have been determined for the workers and these are published in the annex of the regulation.

- Workers are required to start work with the lower score of the group they belong to.

- For every three years of successful service in the same group in the workplace, one point should be added, and if the newly recruited workers document their years of successful service in the profession, these services should be evaluated according to the same principles.

- The points to be found in this way should not exceed the upper limit of the group.

- If the worker assigned to a higher group has reached the upper limit score in his/her old group, he/she should receive one point more than the lower limit score of the new group.

- The documents regarding the assessed service periods must be kept among the records of the workplace.

- All the points corresponding to the work performed by the workers working in the services according to the point scale must be taken into consideration.

- In addition to the wages paid by the employer to the workers working outside the service, 25% of the points shown in the points table in return for the work they do, and 5% of the points to be determined in Group 1, in addition to the wages paid by the employer, should be given to the managers and deputy managers of the departments responsible for the first degree and the officials above them.

- In the calculation of the money to be paid by the employer in return for week holidays, national holidays and general holidays and annual leave wages of the workers working outside the service, the shares of these workers shall also be taken into consideration.

- According to the provisions of the Regulation, the wages, social benefits and other rights of the workers working outside the service should not be reduced and the minimum wage should not be completed with the percentage share.

- According to Article 10 of the Regulation, the principles in the Labour Law shall be taken into consideration in the calculation of the holiday wages of the workers working with the percentage method. Accordingly, in accordance with Article 49 of the Labour Law, the holiday wages of workers working with the percentage method are calculated by dividing the wage in Turkey earned during the payment period by the days worked. The payment period specified here is one week for week holiday, national holiday and general holiday wages and one year for annual leave wages between the date of employment and the date of leave.

- In these workplaces, annual leave wages, national holiday and general holiday wages and week holiday wages must be paid by the employer apart from the money collected by percentages.

According to these principles, in a workplace where the percentage method is applied, the money collected as above must be divided by the total number of points to be evaluated in the workplace and then each worker must be paid the amount to be found by multiplying the points by this amount.

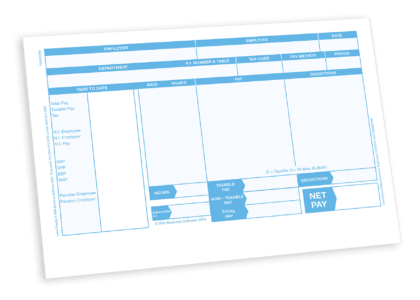

Again, according to the provisions of the law and regulation, the money distributed in this way must be documented. The employer is obliged to give the document showing the general total of each account slip to the union representative in the workplaces where the collective labour agreement is applied, and to the elected workers’ representative in other workplaces. The form and application procedures of the document shall be specified in the labour contracts or collective bargaining agreements.

The explanations regarding the evaluation board regulated in Article 8 of the Regulation are analyzed below under the heading “Boards to be Established”.

The most common problem that may be encountered regarding the payment of wages in workplaces where wages are paid on a percentage basis is whether a basic wage is guaranteed to these workers. Since the minimum wage cannot be lower than the minimum wage and the wage according to the percentage method varies from day to day, the wages should not be below the minimum wage in the workplaces where wages are paid according to the percentage method. Accordingly, if the wage resulting from the calculation made by percentages is below the minimum wage in Turkey, the difference should be covered by the employer.