In Turkey, the Social Security Institution (SGK) plays a vital role in ensuring the well-being and social protection of employees. Employers and employees alike are required to make regular contributions to the SGK to finance various social security benefits, including healthcare, retirement, and unemployment insurance. This article serves as a comprehensive guide on how to pay SGK contributions in Turkey, outlining the necessary steps and providing essential information for employers and employees.

- Understanding SGK Contributions

SGK contributions are mandatory for both employers and employees in Turkey. The contributions are calculated based on the gross monthly salary of the employee and are divided into different categories, including health insurance, retirement insurance, and unemployment insurance. Employers are responsible for deducting the employee’s share of the contributions from their salary and making their own contributions on behalf of the employee.

- Registering with SGK

Employers must first register with the SGK before they can start making contributions on behalf of their employees. The registration process involves submitting necessary documents, such as company information, tax identification number, and employment records, to the local SGK office. Once registered, the employer will receive a unique SGK number and password, which will be used for online transactions and communication with the SGK.

- Obtaining Employee Information

Before making SGK contributions, employers need to collect essential information from their employees. This includes personal details (such as name, identification number, and address), employment contract, and a copy of the employee’s identification card. Employers must ensure that all employee information is accurate and up to date to avoid any discrepancies or issues with contributions.

- Calculating SGK Contributions

SGK contributions are calculated based on the employee’s gross monthly salary. The exact contribution rates may vary depending on factors such as the type of employment contract, industry, and the employee’s age. It is essential for employers to consult the latest SGK regulations or seek guidance from an accounting professional to accurately calculate the contributions for each employee.

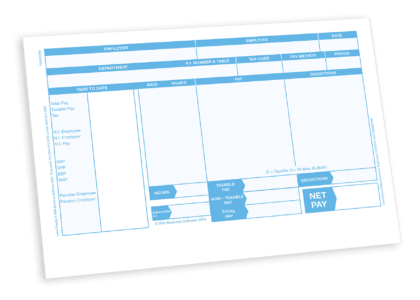

- Deducting Employee Contributions

Once the SGK contributions have been calculated, employers must deduct the employee’s share from their monthly salary. The deduction should be clearly indicated on the employee’s pay slip, detailing the specific amounts allocated for each category of social security (health insurance, retirement insurance, and unemployment insurance). Employers must ensure that these deductions are made in compliance with the SGK regulations.

- Making Monthly Contributions

Employers are responsible for making the monthly SGK contributions on behalf of their employees. Contributions must be submitted to the SGK by the 23rd of each month for the previous month’s payroll. Employers can choose to make the contributions either online through the SGK’s official website or through authorized banks. The SGK number and password obtained during the registration process will be required for online transactions.

- Reporting and Documentation

Employers are required to keep accurate records of SGK contributions and related documentation. This includes maintaining payroll records, pay slips, and proof of contributions made to the SGK. These records may be subject to periodic audits by the SGK or other relevant authorities. It is crucial for employers to ensure the accuracy and completeness of their records to avoid penalties or legal issues.

- Staying Updated with SGK Regulations

SGK regulations and contribution rates may change periodically, so it is essential for employers and employees to stay updated with the latest developments. This can be done by regularly visiting the official website of the SGK, consulting with accounting professionals or legal advisors specializing in labor and social security law, or attending relevant seminars or workshops.

- Seeking Professional Assistance

Navigating SGK contributions and compliance can be complex, particularly for businesses or individuals with limited experience in Turkish labor laws and regulations. Employers and employees may find it beneficial to seek professional assistance from qualified accountants or labor law experts who can provide guidance on SGK obligations, assist with calculations, and ensure compliance with legal requirements.

Conclusion

Paying SGK contributions in Turkey is an essential responsibility for both employers and employees to ensure social security coverage and benefits. By understanding the registration process, collecting accurate employee information, calculating contributions correctly, deducting employee shares, making timely payments, maintaining records, and staying updated with SGK regulations, businesses and individuals can navigate the process effectively and fulfill their obligations. Seeking professional assistance can provide additional support and ensure compliance with SGK requirements, facilitating a smooth and efficient contribution process.